Sales Process… meet Buying Process; and why context trumps segmentation

I’ve been doing some thinking in advance of getting stuck into the development of open standards for User Driven and Volunteered Personal Information. That work is being done here if you are interested in joining in. I’ve been thinking mainly about how best to explain what happens to buying processes and sales processes when volunteered personal information is added to the mix (underpinned by the personal data store/ My Data as set out here).

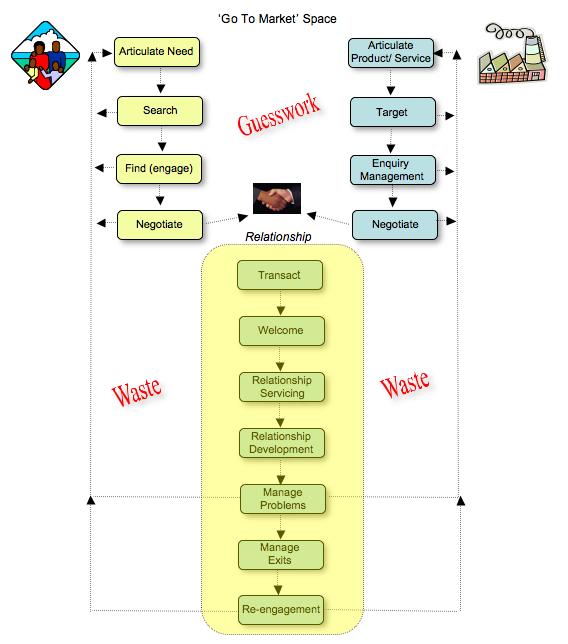

Here’s my stab at that explanation. I need firstly to set out a view of how things currently work – that’s in the first diagram below with individuals/ high level buying processes on the left, and organisations/ high level selling processes on the right. In short, at present, buyers and sellers largely do their own thing/ practice non-automated selective disclosure prior to engaging in an actual customer/ supplier relationship. That is structurally the best option for a buyer, certainly in terms of reducing complexity and protecting negotiating positions for more expensive/ complex purchases – but it does lead to a lot of guesswork; the buyer typically evaluates multiple options before deciding on one – that’s part of the guesswork referred to in the diagram below. This ‘one step removed’ approach is not the best option for the seller – which is why they try a wide range to tricks to have the potential customer engage with them. That would appear a sensible practice, but in reality it tends to fill up the ‘sales funnel’ with many potential customers who actually have no right nor reason being there – and why direct marketing conversions from prospect campaigns are often well below 1%. That’s the the other part of the guesswork in the diagram. At the relevant point in the process, the customer chooses one of the supply options and decides to commence the customer-supplier relationship; the other suppliers fall by the way side/ wonder what’s happened. But those who lost out, because they don’t have the information to do otherwise, keep on turning the marketing handle – lot’s of waste comes from that area.

Moving through the process, commencing the supply relationship in the current mode means interacting on a supplier run platform, and signing up to supplier generated terms and conditions (or going elsewhere to another supplier silo/ get the same result). What that then does is put the organisation unilaterally in charge of processes and process improvement around relationship management. As a historical note, in my view this is where CRM ‘went wrong’ in the widest sense – at least in part because many deployments occurred during the economic downturn in the early 2000’s. It moved from a having been brought in as a platform for driving improvements in the customer experience, to being run as a platform for cost cutting and for risk managment; e.g. the drive to automated processes such as web based customer self-service, offshoring contact centres. Sometimes this automation worked for customers (e.g. online banking), in many cases all it did was move the waste/ inefficiency onto to the customer. Of course what then happened was that customers took their business elsewhere, where they had that choice/ a better option, or stayed but with reduced levels of satisfaction – crazy in that customer retention and satisfaction improvements were almost certainly key drivers for the original CRM business case.

So, the current process does not work that well; the sales process cannot be optimised much further within the current tool-set . But options for improving upon this are now emerging – and not through pedalling faster within the organisation/ the selling process; it comes from building capability on the buyer side/ enhancing the buying process. (note the clear parallel with how selling professionalised in the B2B world when professional procurement and its processes emerged, and also that in the B2B world deals are often concluded and managed on the customer side systems).

The first thing to note in the updated diagram below is what the individual brings to the party (via their personal data store/ user driven and volunteered personal information. They bring the context for all subsequent components of the buying process (and high grade fuel for the selling process if it can be trained to listen rather than shout). By ‘context’, I mean the combination of a wide range attributes that describe the individual and their specific buying situation. This would typically include their needs, their current understanding of how their needs relate to products/ services, their location, their existing supply relationships, their preferences (brand, colour), their role in the decision-making process, their timescales, how much they wish to/ are able to spend, when they wish to buy. In other words, the individual’s context bundle is what much of the early part of the sales process is actually trying to figure out – but can’t get access to as the individual has no current incentive to release it in full. The best an organisation can do at present is strategic segmentation of their market (differentiating products or services based on aggregated customer requirements), and tactical segmentation of their messaging content, communications channels, sales outlets or pricing. Then it’s over into guesswork mode – can we put our messages out in the right places to attract our potential customers and suck them into our sales process…..

The other adds to this second diagram are the ten numbered boxes, reflecting that the improvements we make to the buying process through user driven and volunteered personal information will impact differently at different points of the buying/ selling process. These ten areas are substantive enough to each require a post of their own, so for now i’ll list them out at the high level below the diagram and come back to them in more detail as the standards work unfolds.

User Driven and Volunteered Personal Information Enabled Improvements

- Search/ Target (sometimes referred to as the Personal RFI, i.e. Request for Information) – through the individual bringing much richer context data to the table, suppliers prepared to engage with these new buying support tools will find that their targeting becomes much more precise, better enabling them to find potential customers whose needs closely match the unique selling propositions in the organisations product/ service offering. In turn, individuals will find that the options made available to them have been pre-qualified to fit their context (to whatever level of detail they have shared). Note – at this stage my assumption is that individuals will be engaging anonymously/ pseudonymously as there should be no need to share personal data in this part of the process. It is likely that new inter/ infomediaries will emerge in this space, acting as the individuals buying agent (4th party/ user driven services).

- Find (engage)/ Enquiry Management (sometimes referred to as the Personal RFP, i.e. Request for Proposals) – through having brought richer data to the table in the preceding phase the individual will now be talking to pre-qualified suppliers (and vice versa), with the qualifying data from both parties available for use in the interaction. Typically this interaction will be about having a more refined/ detailed discussion about a need/ requirement/ solution axis – potentially involving either or both parties asking for more detail, including possibly verification of data asserted in the search/ target phase. It is likely that new inter/ infomediaries will also emerge in this space, quite possibly spanning the Search and Find requirement for individuals and done from the perspective of enabling the individual to buy solutions to their needs rather than the components which they subsequently stitch together themselves.

- Negotiate – In this stage the individual is talking to one preferred solution option and getting down to the actual proposed ‘deal’ and the terms and conditions around that – provided by either party. Improvements in this area are likely around improved transparency of terms and conditions, initiated by the individual being much clearer about their requirements, and having access to comparison tools earlier in the process. ‘Reputation’ management tools will also come into operation as the individual shares what they find out about suppliers.

- Transact – I would expect payment intermediaries/ financial services providers to find creative ways to engage with/ be driven by VPI enabled services; there is certainly much potential for reduction in credit card fraud and card related identity theft from using the much higher levels of identity assurance that will become the norm in a VPI enabled data-set.

- Welcome – This ‘relationship set up’ phase is typically about both parties getting to know each other, i.e. getting products/ services bought set up and configured, ensuring any ongoing account management/ billing is up and running smoothly. In the VPI enabled world this phase won’t change too much in the short term as it will still run mainly on supplier systems – but in the mid and long term i’d expect it to shift to a genuine user-centric architecture which will see the individual ‘welcome’ the new supplying organisation to their personal supply network/ federation.

- Relationship Servicing – This is what would typically be called customer service, i.e. fixing basic operational/ service delivery problems and dealing with ad hoc issues that come up such as change of address/ change of contact details/ change of payment details. As VPI enabled tools increasingly emerge, i’d expect this whole ‘change of’ to migrate to the ‘my suppliers follow me’ approach rather than the individual have to run around updating silos as per the current model.

- Relationship Development – This typically includes the ‘cross-sell/ up-sell’ much beloved in the CRM business case. This stage will change in the VPI enabled world, much for the better. Customer service will be provided within the context of the individuals existing solution set rather than that little snapshot of it that the supplier currently sees/ is interested in. In turn that will mean that cross-sell and up-sell will be not only be much more informed, but it will also be much more welcome from the individuals perspective – because it is now laser sharp, and running within a more equitable customer/ supplier relationship (partnership).

- Manage Problems – This stage is only reached if a significant problem emerges in the customer/ supplier relationship; typically this involves escalation beyond tier 1 customer service (and an increasingly frustrated/ angry/ upset customer). I don’t expect the VPI approach to have a high impact in this area, although improvements further up the process might have a knock on effect rendering this stage less painful if/ when it occurs.

- Manage Exits – Exits can and will happen, either permanently or for a period of time. They may be caused by significant problems that emerged, or by a change in the customer need, or in their circumstances (their context has changed). Less frequently, a supplier will wish to leave a market or terminate a product/ service line and thus exit those relationships affected. In the VPI world, i’d expect there to be more information around impending exits and reasons for them – some of which will enable creative supplier responses. Along with relationship development, i’d expect improved customer retention to be one of the major wins for the supply side in the VPI world – but the plumbing and mechanics for that have stilled to be worked out.

- Re-engagement – This stage might be known as ‘win-back’ in CRM speak, and involves the lost customer being targeted with appropriate offers to return. For the individual this return to the fold might be as a result in a time-driven change of context, or that the ‘grass was not greener on the other side’ – as is often the case in utility service swaps away from an incumbent that has retained quasi-monopoly advantages. In any case, the point being made here is that in the volunteered personal information scenario, the individual would be in position to retain and share the knowledge of the prior relationship – which many current CRM architectures fail to deliver on.

So there we have it. Time to get back to working on that VPI plumbing!!!