The Customer – Supplier Engagement Framework

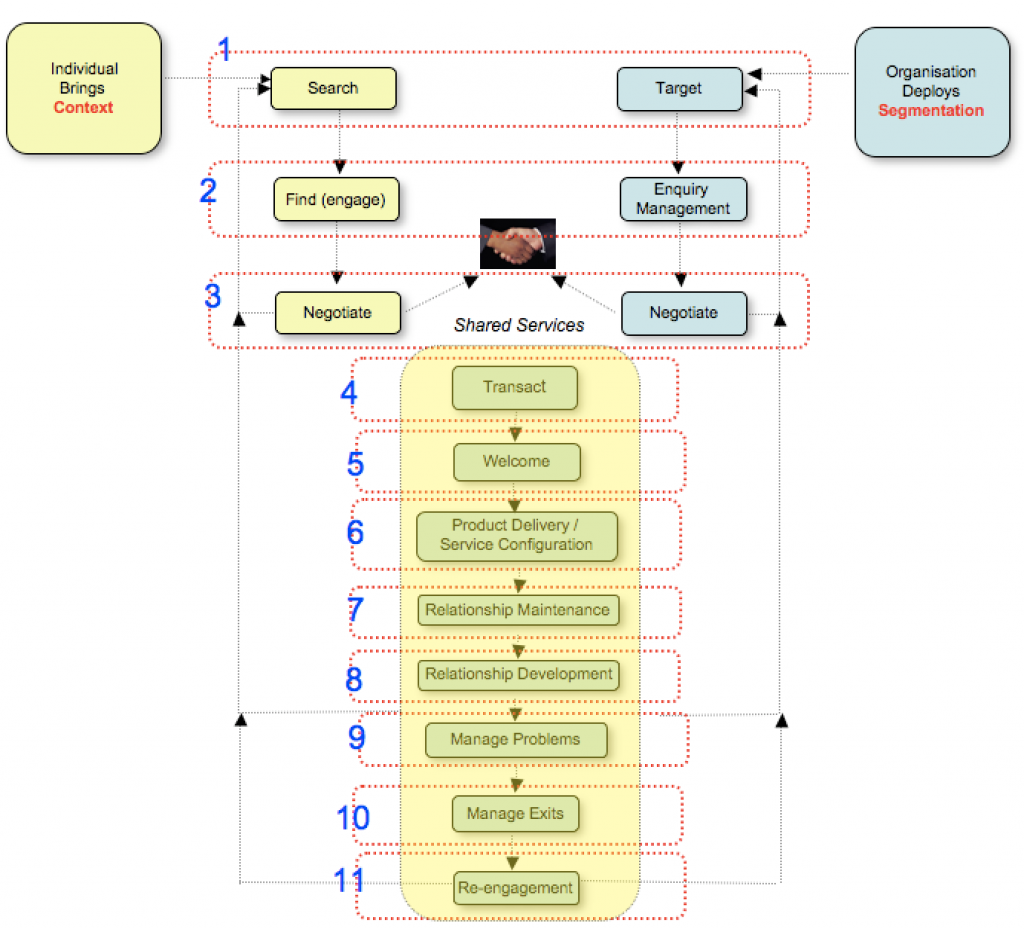

Over the past few months, The Information Sharing Work Group at The Kantara Initiative has done a bit of a deep dive into an end to end ‘car buying and using’ scenario. We used the diagram below, summarised in this post, to give us context and structure and allow us to break the backwards and forwards interaction between customer and supplier into digestible chunks within an overall framework.

Note: Those studying the model closely will see that i’ve broken out the previous ‘Relationship Servicing’ box into two (Product Delivery/ Service configuration, and Relationship Maintenance); when I was reviewing that area it became clear that there was more detail in there than the one high level heading could support, and that significantly different processes are going on in those areas).

As we have worked with that methodology, it has stood up to the test – so it’s about time it had a name, and a bit of a deeper dive description. So here goes, let me introduce……(drum roll…..), The Customer-Supplier Engagement Framework…..

…So what does that mean then? In essence this work is a built out from many years of work on customer management issues in which colleagues and I used one model in particular (the CMAT model) to describe the big picture of how an organisation manages it’s customers. That model is excellent, has been tried and tested in 600+ organisations worldwide, and has fuelled many a good CRM deployment, but when I think about it with a ‘VRM’ hat on I came to realise that we need not only an equivalent model of what the buyer/ customer on their side of the process, we need a model that shows the inter-relationship between the buying process and the selling process. That’s what The Customer – Supplier Engagement Framework is about; it sets out eleven steps of the combined buying/ selling process and shows the flows within and across the two.

Now clearly we’re not building that framework to show how wonderful the current state is; because it’s not. It’s full of waste and missed opportunities for added value…FROM BOTH PERSPECTIVES.

There are two main reason that this eco-system is full of waste and missed opportunity in my view:

1) One side (the selling side) is fully kitted up with the tools of their trade….data warehouses, web sites, CRM systems, and an army of people paid to do the work. The other (the buying side), has nothing more that some self-assembled, amateur tools….and their brains. They don’t get paid to do it, and they typically don’t have a lot of time set aside for the process (my wife shopping for shoes aside….). That imbalance between the ‘have’s and the have not’s, as in any walk of life, leads the ‘have’s’ to take advantage, and the ‘have not’s’ to rebel against this in whatever way they can, or (more often) they just don’t engage as they might in a more balanced and equitable relationship.

And it’s not as if the individual can just walk away from the imbalanced relationship, in many product/ service categories part of the supplier kit bag is the tactics of ‘lock-in’, and the individual typically does not have the resources or the time to invest in breaking out..

2) Overall supply outweighs overall demand across many categories…so the net position is that there are a lot more suppliers losing out on pitches than there are who are winning the business…., with all that marketing and selling effort being wasted.

So this framework is about enabling us to isolate potential improvement areas without losing the overall context. It’s main impact, I would hope, would be on the buyer side; that’s the area where most time is wasted and where least work has been done to date. But it will also enable much improvement on the seller side, which is where most money is wasted at present.

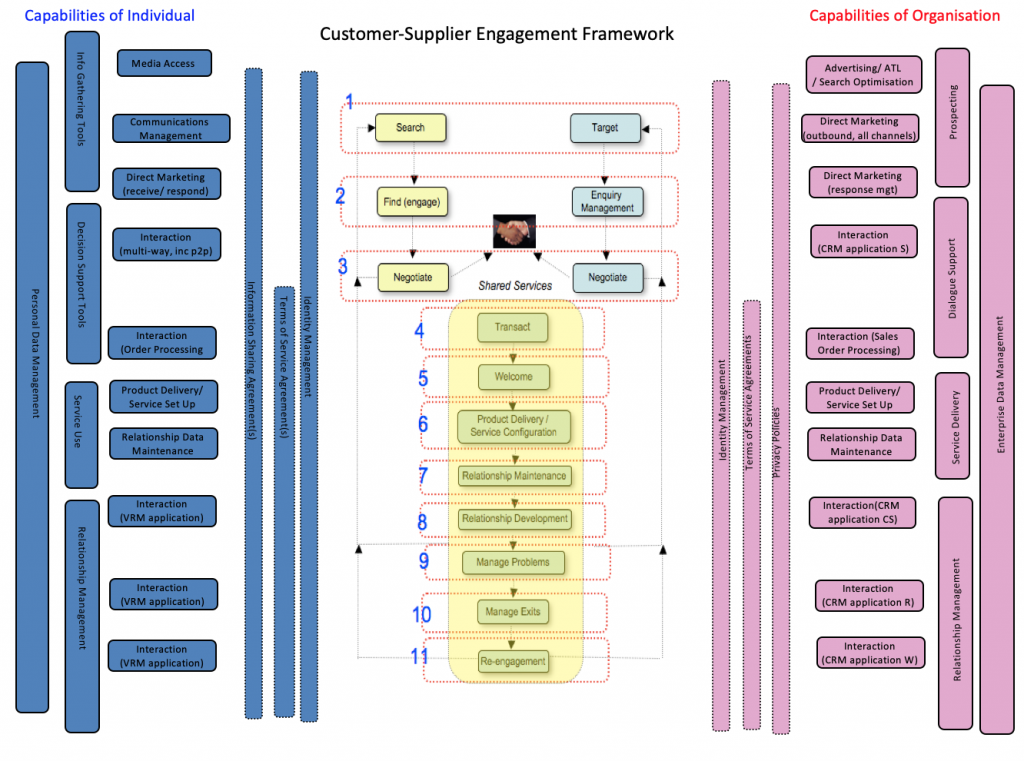

The build below seeks to illustrate the current situation in terms of the capabilities that sit behind each of the parties. Those on the buyer side have been most actively built out over the last 20 years, beginning with the data warehousing boom of the late 1980’s, and then through the CRM and e-commerce fuelled growth spurts. The spend on this side is enormous, CRM software applications alone are thought to amount to a $10bn a year market, and that’s only a tiny proportion of the spend overall represented on the diagram. On the seller side, there’s clearly a lot goes on, but in terms of capabilities able to engage on anything like a ‘peer to peer’ relationship with the seller side, then it’s pretty much empty space right now. But the good news is that there are lots of people working away on that. It’s tough, no doubt about that, because just as on the seller side, the base level data management capabilities that span in-house silo’s are key; we’ll call them ‘personal data stores’, although this a generic term for a fairly wide range of personal data gathering, managing, analysing and (optionally) sharing processes and tools. Just as in the data warehousing area on the organisation side, there is no real business case for the personal data store as a stand alone entity; but when it is tied to the applications that tap into it, then the potential value/ return on personal investment is enormous.

I guess that’s enough complexity for one post, so my plan from here is to take each key area in turn (either capability or improvement opportunity), targeting one per week – and building out that story. I’ll kick that off with a deep dive into the personal data store, the base level plumbing for the buyer side of the framework.